Private markets are no longer the exclusive playground of institutions and the ultra-wealthy. Once tightly held territory has begun to open with increasing momentum. Across asset classes, new sources of capital flows are expanding as high-net-worth individuals, digital wealth platforms, and retail investors step more meaningfully into the fold.

- All

- AI and Emerging Technology Integration

- Aviation

- Capital Markets

- Company News

- Consumer Brands

- Content Strategy

- Corporate Communications

- Crisis and Issues Communications Management

- Digital Communications

- Education

- Energy and Environment

- Environmental, Social and Governance (ESG)

- Financial

- Government and Public affairs

- Health

- International media

- Media Relations

- Multimedia Design and Production

- Primary Industries

- Professional Services

- Property and Infrastructure

- Public Relations

- Research

- Strategy

- Technology

- Travel and Hospitality

Private markets are no longer the exclusive playground of institutions and the ultra-wealthy. Once tightly held territory has begun to open with increasing momentum. Across asset classes, new sources of capital flows are expanding as high-net-worth individuals, digital wealth platforms, and retail investors step more meaningfully into the fold.

The Sandpiper Group (“Sandpiper”), the largest independent communications, public affairs, and research group with offices and operations across Asia Pacific and the Middle East has announced the launch of Sandpiper Financial, supported by several senior appointments to lead this new division.

Our Reputation Capital financial services research features the responses of 307 global leaders in the financial services sector – financial advisors, asset managers, bankers, private equity, fintech and more – across six contents.

On 3 May, both Australians and Singaporeans went to the polls, with regional observers closely monitoring their respective federal and general elections for domestic implications and broader geopolitical impact. Just days earlier, on 30 April, President Trump marked his hundredth day in office – during which his administration has had deep impacts across Asia.

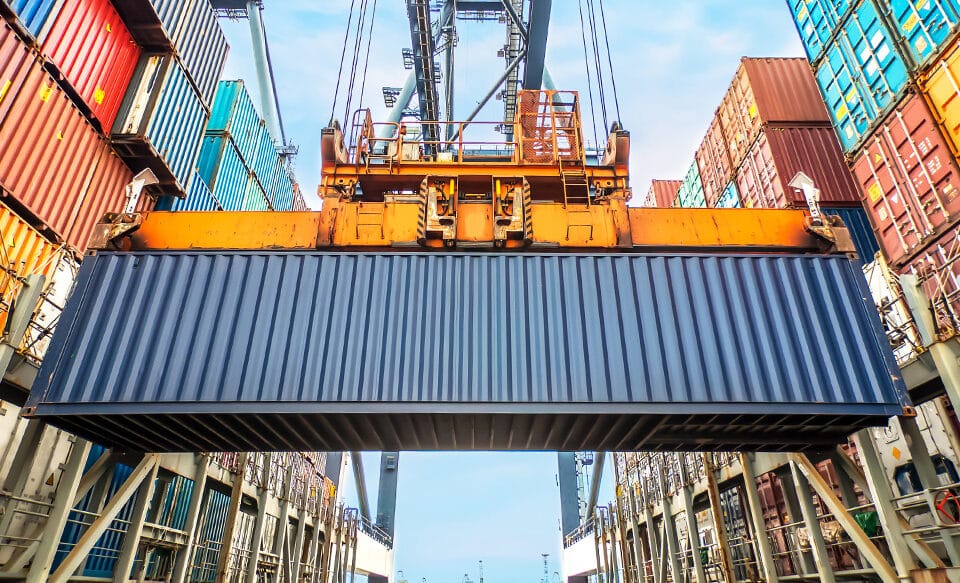

Sandpiper is publishing a detailed research report on its Turbulent Times research of 3,050 business leaders in 27 countries. It shows 73% believe a fundamental cause of the tariff and trade conflict is the policies of the current US administration, against 62% who say it is China’s trade policies. Despite high levels of anxiety, 38% of business leaders in ASEAN countries and 21% in China say they are not well prepared to deal with current geopolitical risks.