Public Affairs Tracker: The Importance of Government Relations in Today’s World

Social Media Listening: A Case Study on Public Awareness of HPV

IPO Communications Strategy: How Comms Can Shape IPO Success

August 2022

by Winston Choo, Director, Sandpiper Singapore. Winston has over 20 years’ experience in corporate and financial communications, , issues and reputation management, strategic media relations, investor relations and stakeholder communications for leading listed companies and private multinational organisations.

When it comes to preparing for an IPO, many organisations treat the IPO communications strategy as an afterthought. Leaving it too late is a missed opportunity, because the comms building blocks need to be in place well before the IPO’s PR campaign begins. Having that robust communications structure in place early will provide a framework for moving forward – essentially, it’s vital to put the comms house in order. Once you become a publicly listed company you are under greater scrutiny, so implementing the frameworks and infrastructure across business functions in advance can help make the company more efficient in the long run.

Leadership considerations for IPO communications strategy

Like it or not, the CEO and CFO are the faces of the company for investors. In the years leading up to the IPO, the CEO and CFO will be spending time attending roadshows, presenting to prospective investors. After the IPO, the CFO will be spending time with investors providing the necessary analysis and insight on performance. Also, there needs to be meaningful board composition, providing the company with a good balance of perspectives and experiences. The board needs to hold the CEO accountable and shape the direction of the organisation. Robust discussions and meaningful debate should be encouraged as a way to bring the company forward and achieve goals. Having a diverse range of representation and genuine commitment to hearing from diverse stakeholders is a good way to encourage the flow of new ideas and healthy debate.

Positioning the CEO and CFO as industry thought leaders

A key aspect of the IPO communications strategy should be ensuring that the CEO and CFO enjoy strong visibility in the marketplace and beyond as thought leaders. Establishing this position takes a year or two of development, depending on the current profile of company leaders. Ensuring a consistent narrative that underlies the broader communications messages is important, with each touchpoint reiterating a consistent company theme. Firming connections with media, investors, industry leaders and the like takes time.

A solid thought leadership framework will include:

- regular industry briefings and insight sharing

- strategic approach to social media, building up a following for transparency and authority

- media outreach and regular interviews with top tier publications

- use of video, speaking engagements, events, podcast and other communications challenges to keep the company leaders visible to influential media

- releasing valuable market insights in the form of research, white papers, opinion pieces and industry briefings

The goal in building up the thought leadership of the company is to establish awareness in the eyes of potential investors, well ahead of IPO day zero. This will create a habit of transparent communications that will put the company in good stead for eventual listing — when it’s all about timely disclosure and communications with shareholders and potential investors.

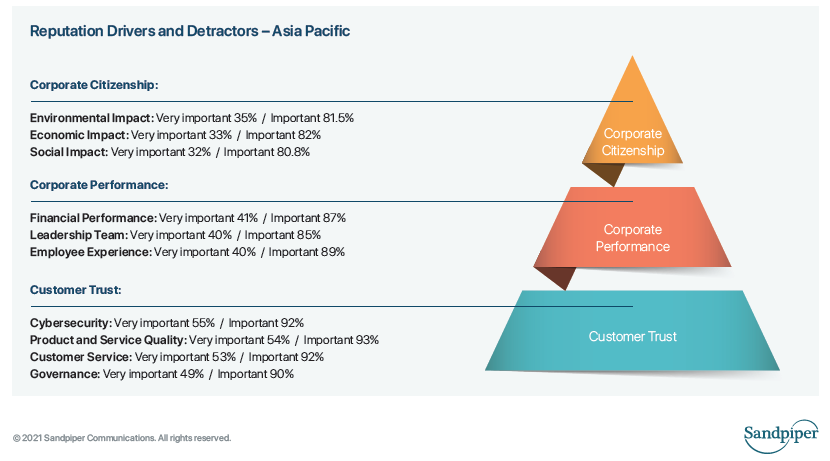

Anticipate ESG scrutiny and get ahead of the conversation

As our ESG and sustainability advisor Julia Walker explains in ESG: moving up the curve, if you are not on the path to net zero, you are out of touch. As the world increasingly focuses on climate change concerns, organisations that get ahead of industry and take leadership positions have an opportunity not only to make significant beneficial changes, they can establish themselves on the front foot as climate change pioneers. With our 2022 reputation capital study showing that 89% of people in Asia Pacific see environmental impact as an important reputation driver, you must get your ESG strategy right ahead of your IPO’s PR campaign moving into higher gear. Taking a strong ESG stance early can also position your organisation as an employer of choice, making your brand highly attractive to employees seeking to align with organisations that share their values and vision for the world.

On the ESG front, an IPO-aspirant company should seek to establish:

- a dedicated chief sustainability officer

- a whole-of-business commitment to ESG

- comprehensive strategy outlining core goals for net zero and plan to achieve them, including milestones to reach along the way

- yearly reporting on progress towards those goals

- strong dedication and focus on ESG matters at board level

- commitment to addressing ESG in its supply chain

- employees and broader stakeholders that demonstrate a strong understanding of the company position, goals and achievements to date

Setting the ground rules for the IPO communications strategy

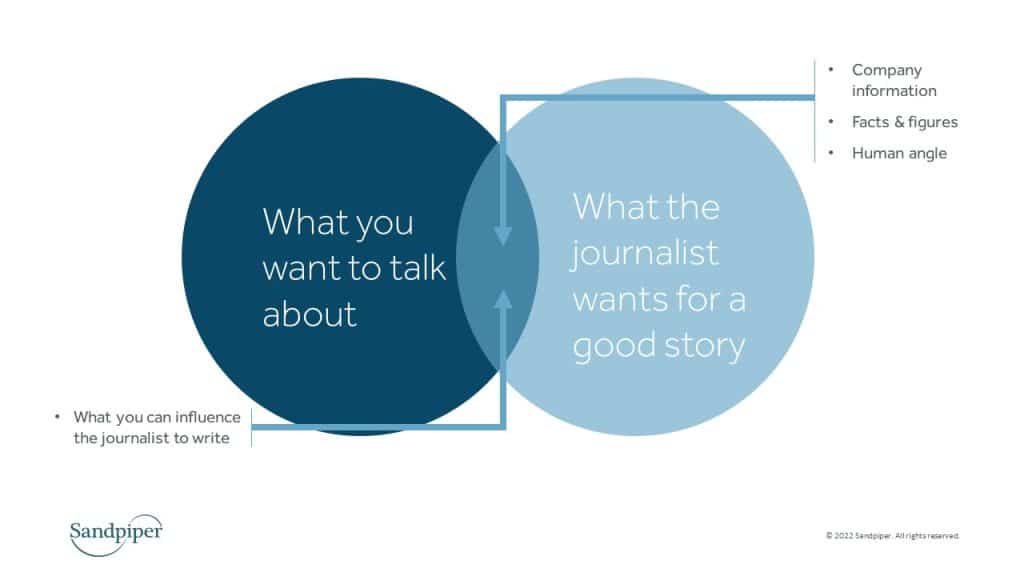

Great media performers aren’t born overnight. Your leadership team and subject matter experts need to build confidence, gaining experience gradually, so when the IPO campaign begins in earnest, your team is ready for the bigger stage. Establishing the communications protocols from the onset will set you up for success. Investing in ongoing media training for the C-suite will help build their confidence in media performance. Following this, securing media interviews with smaller-tier media at first, then graduating to bigger players will allow the team to grow their skills and confidence with regular practice.

Engaging the press early will allow the C-suite to build personal relationships with individual journalists and establish themselves as useful resources for media commentary and insight. If a company that has been quiet on the media front suddenly announces plans for an IPO, journalists will be starting from much lower awareness and won’t have a clue about the company or its team.

Identifying target investors

The other arm of the IPO communications strategy is securing anchor investors that will stick with the company in the long term. The odds of having a successful run as a public company are improved by getting investors to participate in meaningful commitments over longer time periods. So the more you can do to foster positive relationships with potential investors before the IPO, the better. A solid IPO strategy will take responsibility to educate investors on what the company has to offer. Ensuring that investors know and understand the value proposition and your plans to scale to future growth is vital. Meetings can be secured on these fronts:

- led by investment bankers that you engage – gathering groups of relevant investors

- investors with a known interest in your sector

- third party target investor lists

Long-term investors bring long-term returns. Institutional investors, such as fund managers and asset managers have a role to play here too. Their job is to follow the market and each has different approaches. Some focus on particular sectors, others on geographic regions. Others seek simply to evaluate based on value and future growth prospects. The slice-and-dice mix helps you approach different kinds of investors. IPO aspirants need long-term prospects. Investors who tap in and out can create instability, so targeting those in it for the long run is vital.

Investor roadshows allow you to meet investors in group or 1:1 settings

Knowing the stories to share and anticipating the questions you’ll be asked is the key to roadshow success. A good strategy before, during and after investor events enables you to position the company in a good place, and one that is poised for growth in the eyes of potential investors. These days astute investors want to see the growth of the company, transparency in financial reporting, growth forecasts and the broader organisational mission. Buzz counts too — people are looking for the latest trends and want to be early adopters. The strategy should seek to create that buzz, while also backing it up with solid proof of potential. A low-buzz campaign will miss opportunities, while an exaggerated campaign will not be able to support extravagant claims, so there must be a balance between style and substance.

Establish procedures as soon as possible

It’s important to have a deep relationship with the bankers you work with, one that is built on trust. An essential part of this relationship is for the investment bank to be transparent and truthful in counsel on the deal dynamics, which includes pricing range and allocations, among others. Having a collaborative relationship with an investment banker will help the company ensure a successful IPO. The right accounting firm is also necessary to ensure your financial infrastructure is in place well before IPO — when the rubber hits the road you will be ready.

Corporate governance matters here too, many forget the G in ESG — if people can see the governance structure is already in place, half the battle is already won. Having established a company mission, vision and values and commitment to the major social and environmental issues of the day is not an optional extra but a must-have. Increasingly, this gives you a big step forward in putting you in front of the investors, especially when a significant number of investors have already integrated ESG and sustainability considerations in their investment decisions.