Sandpiper Grows Energy, Environment and ESG Team in Singapore with Four New Appointments

Entry Level PR: How to succeed in your first agency role

ESG Strategy: Moving up the curve

April 2022

By Sandpiper’s dedicated ESG Advisory team. Our team has extensive experience working with internal and external stakeholders across a variety of teams and disciplines – from communications to operations – to help organisations shape and refine their ESG strategies and communications.

When it comes to ESG strategy for private and public organisations, if you are not on the path to net zero, you are out of touch. The world has tremendous challenges that need to be resolved. The 2021 IPCC report was clear and the picture is grim: humanity is responsible for climate change, we need to act now to avoid further irreversible damage.

ESG as a key driver of strategy and reputation

We know via Sandpiper’s exclusive Reputation Capital Report for 2022 that 82% of people have increased their interest in sustainability issues after the pandemic. ESG factors are very important in goodwill towards an organisation across Asia Pacific:

- 90% agree that governance is very important reputation driver

- 82% agree that environmental impact is an important reputation driver

- 81% agree that social impact is an important reputation driver

Many organisations understand that they need to take these issues seriously, however many have barely scratched the surface to align with the rate of change needed to stay within planetary boundaries with their ESG strategy. This exposes them to a variety of risks that have the potential to evolve into a complete crisis.

While the commitment to improving ESG business strategy must be owned at a board level, it often falls to the communications teams in the first instance to become the internal champions of change. These teams may struggle to articulate the value and scope of work to senior executives.

A good place to begin is to evaluate the stages of an ESG strategy, and the level of risk and opportunities it poses to the greater organisation.

ESG Strategy Stage One: Lacking strategy, analysis and intensity

| Stage One | Characteristics |

|---|---|

| Board involvement: | nil |

| Activities: | ad hoc activities limited to charitable endeavours, donations |

| Internal resources: | minimal and ad hoc throughout the organisation |

| Risk level: | high |

| ESG framework and reporting: | non-existent |

Concerningly, some boards see ESG strategy as a ‘nice to have’ demonstrating little commitment beyond lip service and statements claiming to ‘take the issue seriously’.

Building frameworks, creating strategies and taking action on ESG factors is a major commitment as it touches all aspects of the business. However organisations that fail to take action now will soon be left behind, as the pace of advancement is rapid.

– Julia Walker

This lacklustre effort exposes the organisation to the highest level of risk, including:

- accusations of greenwashing requiring extensive crisis management

- attacks from lobby groups and activists on green credentials

- being unable to prove any claims or report on the ESG activities undertaken

- alienation of staff due to lack of action, leading to retention issues at best and whistleblowing at worst

- Loss of revenue / sales, due to misunderstanding of changing demands, physical and transition risk

Publicly listed organisations at this ESG strategy level are at least forced into action via growing compliance regulations and disclosures. Therefore privately owned companies tend to be further behind. While the dedication to change can be high, there can be uncertainty on where to start. Building frameworks, creating strategies and taking action on ESG factors is a major commitment as it touches all aspects of the business. However organisations that fail to take action now will soon be left behind, as the pace of advancement is rapid.

ESG Strategy Stage Two: Moving up the curve

| Stage Two | Characteristics |

|---|---|

| Board involvement: | minimal |

| Activities: | loosely aligned to the strategy, but lacking cohesion, tends to focus on communications rather than action |

| Internal resources: | good, typically has a dedicated team or single resource |

| Risk level: | medium-high |

| ESG framework and reporting: | policies exist, sustainability report published, but may lack detail |

This stage is where many organisations in Asia Pacific sit. While this is a very good start, more needs to be done. The ESG strategy exists and the board has a stated position which is typically aligned to global best practice. However, the organisation may struggle to integrate and communicate its vision. The strategy tends to be high on promises but less able to demonstrably prove itself. Reporting tends to be weak, and the ESG business strategy has yet to permeate all touch points of the organisation. This level of under-resourcing puts a single person or a team in charge of the Sustainability framework — essentially ‘leaving them to it.’

On a risk level, organisations at this stage of ESG strategy will be vulnerable to its own lack of ability to communicate with important stakeholders. Any kind of scrutiny from activists or lobbyists may result in unwanted speculation, as the policy doesn’t empower the organisation to confidently report on its activities. There may be a disconnect between the commitments made in the ESG business strategy and the complete supply chain of an organisation’s products, services or solutions. For example, an organisation may outwardly commit to sustainable initiatives, while internally maintaining investments in the production of coal, single-use plastic, tobacco or other environmentally or socially questionable practices. Therefore these companies are tempted to be quiet about any activities, for fear of skeletons in the closet being exposed.

ESG Strategy Stage Three: Getting in front of the game

| Stage Three | Characteristics |

|---|---|

| Board involvement: | high |

| Activities: | strategic and measured |

| Internal resources: | plenty, headed by a Chief Sustainability Officer |

| Risk level: | low |

| ESG framework and reporting: | comprehensive and market leading |

Organisations at this stage are taking a peer-leading position and have a whole-of-business commitment to ESG strategy. With dedicated internal assets and resources headed by a Chief Sustainability Officer, it can confidently stand up to scrutiny and actively communicate its position to its stakeholders.

With the internal activities operating seamlessly, and considerable efforts being made to analyse and report on achievements, organisations at this stage are now looking to partner with external stakeholders and government to accelerate change and tackle more challenging concepts. This means actively participating in task forces and industry alliances and generating industry and broader recognition for its endeavours.

Whereas organisations at levels one and two tend to prioritise corporate responsibility and sustainability, this company will take a more holistic approach, covering more of the net zero, circular economy, social and governance aspects, articulating a strong position.

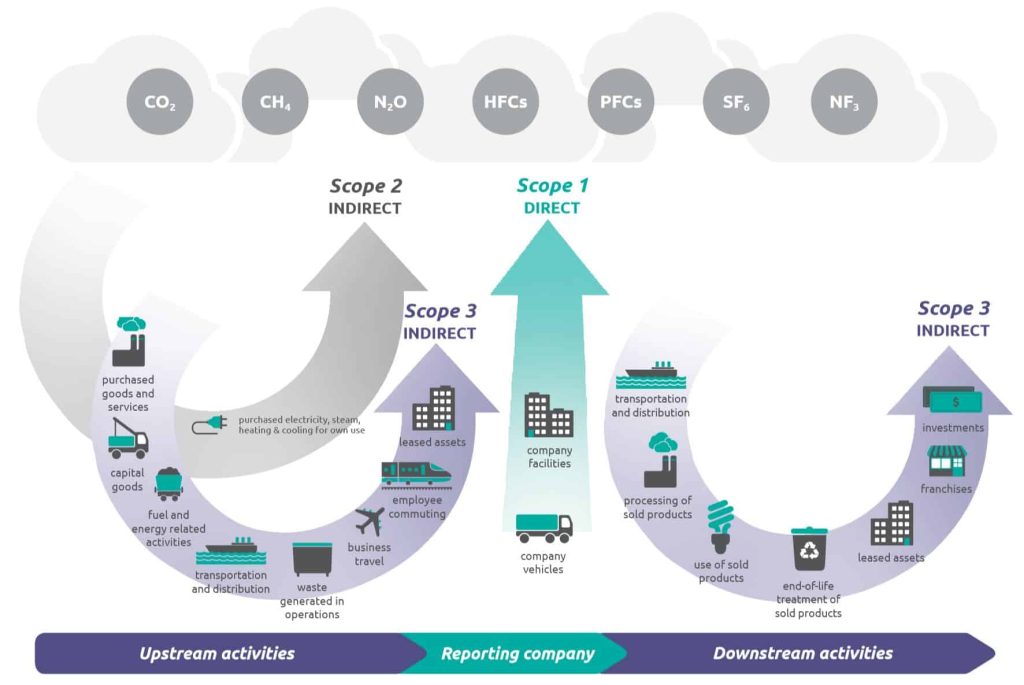

This company will now be seeking to understand its entire supply chain, transport and how their products and services are used (Scope 3 emissions).

At this stage there is true belief from employees of the company’s commitment. There may however still be challenges regarding communicating that position and ensuring that important stakeholders are all communicated too: customers, government, employees, suppliers, media and the public. Leveraging this high level of activity to influence public reputation is key for an organisation to ensure the good work being done is accessible and understood by its key stakeholders.

ESG Strategy Stage Four: Industry leadership

| Stage Four | Characteristics |

|---|---|

| Board involvement: | absolute |

| Activities: | consistent, well-funded, strategic and measured |

| Internal resources: | plenty, headed by a Chief Sustainability Officer |

| Risk level: | minimal |

| ESG framework and reporting: | comprehensive and market leading |

Organisations at this level of ESG strategy are giving equal weight to the core elements of ESG and have worked through a net zero transition and value chain action plan. With a complete commitment to transparency, its quality reporting and communications strategies ensure that it is able to proactively communicate its vision and credentials. Disclosures have gone beyond the standard disclosures (GRI / TCFD / SASB) and Science-Based Targets have been developed. They may be looking at their alignment with the planetary boundaries, their Future Fitness and Nature Based Accounting. CDP recently advised that currently only 1% of companies who submit data to them provide enough information to assess if they have a credible transition plan.

Customers, employees, government, media and stakeholders are likely to comprehensively understand and articulate the company vision and agree that the organisation is a market leader in the ESG space. This level of commitment provides a solid base on which to build, freeing the organisation to turn attention to Net Zero Strategy, social and climate justice, championing diversity and broadly investing in impactful adaptation and mitigation actions. This activity positions the company as an employer of choice and makes it a highly appealing prospect for values-aligned employees to join the company and be part of true social action. With such a powerful corporate reputation, risk to the company is minimal and it is supremely placed to be at the forefront of true and lasting change.

Reaching the upper stages takes a strong commitment at board level

Working with organisations to help develop and implement ESG frameworks strategies and thought leadership has allowed us to witness first-hand the power of incremental improvements. Communications teams are well placed to act as internal agitators and lobbyists. Often, the key to inciting further action begins with highlighting the level of risk organisations face at levels one and two. At the more advanced levels, effectiveness relies on painting a picture of what is possible, inspiring the tremendous change that can and will take place when organisations set themselves up for future ESG strategy success.

You may also like: