A World Recalibrating: Strategic US Absenteeism is Accelerating ASEAN’s Regional Integration

How Can Big Tech Manage Its Reputation Better? It’s a Matter of Trust

Sandpiper Reputation Capital Research: Managing Reputation in the Financial Services Sector

May 2025

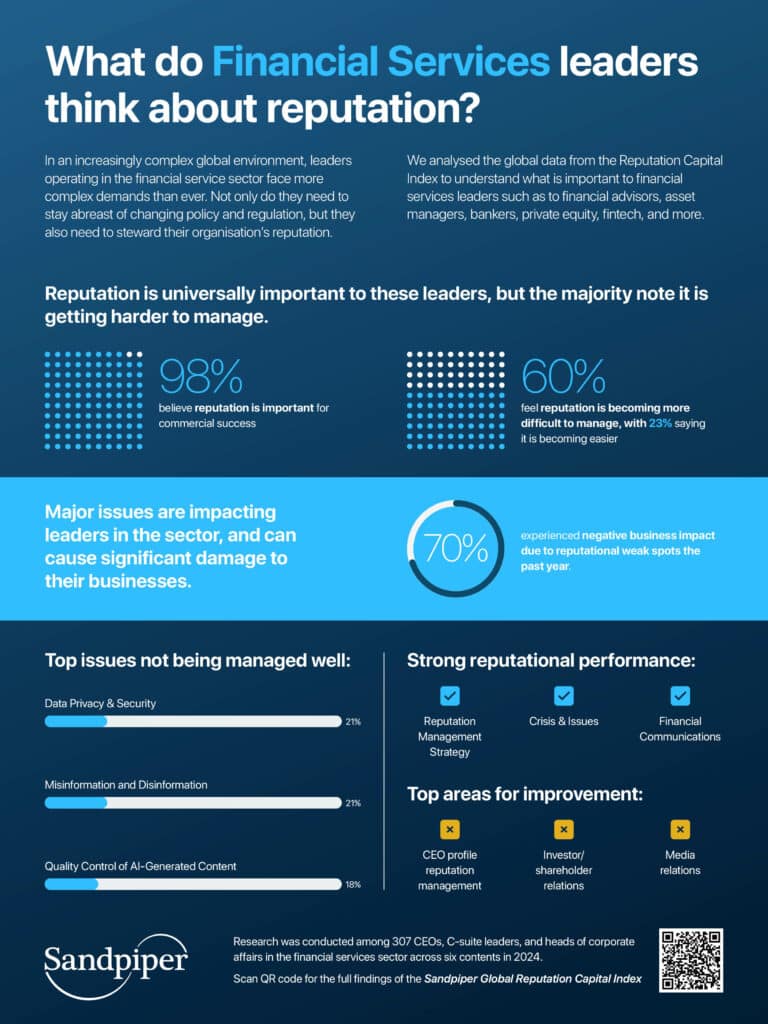

In 2025, the financial services sector is undergoing a radical transformation driven by emerging technologies, evolving customer expectations, and growing demands for transparency, resilience, and financial inclusion. Against this backdrop, new Reputation Capital research from Sandpiper provides useful data and insights on the ever more crucial area of financial services organisations’ reputation.

We launched our Sandpiper Global Reputation Capital Index in late 2024 and have since been drilling down into the data for individual sectors. Our financial services research features the responses of 307 global leaders in the financial services sector – financial advisors, asset managers, bankers, private equity, fintech and more – across six contents.

While 76% of financial services sector respondents rated all key areas of reputation management as important, only 47% rated their own organisation as being strong in this respect.

Our research also shows that reputation management is becoming harder, with 60% of financial services sector leaders noting it has become more difficult in the past year, compared to only 23% saying it is getting less difficult. Leaders in the sector are also highly likely to face organisational risks based on reputational weakness.

In our research we group respondents into performance-based categories – Trailblazers (12%), Aspirants (54%), Followers (32%), and Beginners (3%) – using 51 separate variables, across nine areas of reputation management. On average, financial services leaders were ahead of peers in other sectors across all areas.

For leaders in the financial services sector, multiple aspects of reputation rank very highly in their contribution to commercial success, including cyber and data security (70%), products and services (64%), and leadership and governance (60%).

Overall, the financial services industry also rates its reputation management capabilities relatively highly in relation to reputation strategy (where its index outpaces the global average by 1 point) and government and regulatory affairs (where it indexes 1.5 points higher). The industry’s government and regulatory affairs reputation capability is partly due to the level of insight the industry has about these audiences, with 89% of financial services leaders saying they have strong audience insights into government and regulator stakeholders.

Cyber and data security is also an area where financial services professionals are some of the most prepared to handle adversity, as 79% said they are moderately to highly prepared to manage cybersecurity and data privacy incidents, while 81% reported being moderately to highly prepared to handle the rise of misinformation and disinformation.

The research also reveals areas where financial services leaders should invest in the future, as well as opportunities for improving reputation management within financial services organisations.

Areas where increased investment to strengthen reputation capital is needed:

-CEO profile reputation management

-Investor/shareholder relations

-Media relations

Opportunities for improving reputation management in the sector:

-Assessing status quo and taking action. Financial services leaders can assess how they perform against the Sandpiper Reputation Capital Index, and then address reputation capital gaps.

-Developing a stakeholder map, researching audience insights, and tailoring messaging to resonate with diverse target groups is central to enhanced reputation management strategies in the sector.

-Strengthening data and cybersecurity threats preparedness builds trust and protect reputation, especially given the sector’s exposure to sensitive information and evolving digital risks.

-A key opportunity to enhance external communications and strengthen reputation lies in improving executive visibility, leveraging SEO, and investing in social media advertising. Increased media engagement by top executives, supported by targeted training, can significantly enhance credibility and reach.

As the financial services industry continue to play a central role in global economic stability, we hope our insights will equip leaders with clear ways to strengthen organisational resilience, build stakeholder trust, and develop stronger reputation capital for their organisations, as well as for the financial services industry.

To view the full Sandpiper Global Reputation Capital Index 2024, click here. The data for the full report was collated from a survey of over 2,700 CEOs, other C-suite Leaders, and Corporate Affairs leaders across industries. All those surveyed are based at the global headquarters of their organisations across 27 markets in six continents.