Navigating the New Era of Healthcare Communications Strategy

Cybersecurity Scams: How Brands Can Win Back Broken Trust

Public Affairs Tracker: “Two Sessions” 2022 – Exploring China’s Pivotal Yearly Legislative Event

March 2022

By Zhou Zhou, Account Director, Sandpiper China. Zhou Zhou has extensive experience in the healthcare and investment industries. Zhou and his team at Sandpiper China have counselled many of the world’s largest healthcare businesses and major international industry associations, including eight of the world’s top ten pharmaceutical companies.

Why are the “Two Sessions” so important?

China’s 2022 “Two Sessions” meetings commenced on March 4 with the start of the Fifth Session of the Thirteenth National Committee of the Chinese People’s Political Consultative Conference followed by the Fifth Session of the Thirteenth National People’s Congress on March 5. As China’s most important annual national meeting, the “Two Sessions” reveal major guiding plans for the country’s economic and social development, as well as formulate national fiscal, financial, and livelihood-related policy comprehensively and systematically —all of great significance to the national economy.

China’s “Two Sessions” are windows for the world to observe China’s development and policy trends. In recent years, as China has continued to act as the engine of the global economy, the world is now paying close attention to the “Two Sessions” in order to learn more about China’s priorities and development plans, as well as to judge the direction of China’s economic policy in the coming year.

What are the key takeaways from this year’s Government Work Report?

Important arrangements and matters during the “Two Sessions” include the Government Work Report, the Prime Minister’s Q&A session, and the detailed plans proposed by ministries and departments such as the National Development and Reform Commission (NDRC), the Ministry of Finance (MoF), the State-owned Assets Supervision and Administration Commission (SASAC), the Central Bank, the China Securities Regulatory Commission (CSRC), etc., on policy reform directions in corresponding fields during the “Two Sessions”. We believe the following areas deserve attention:

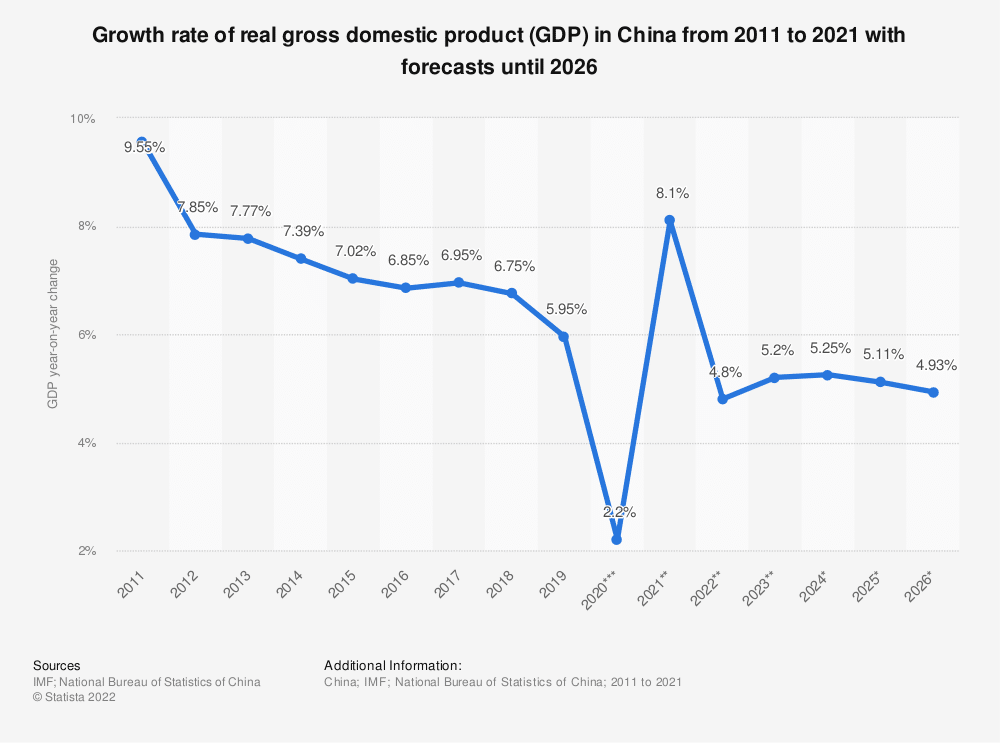

- The Government Work Report sets the 2022 GDP growth target at around 5.5 percent

- Why is this number under the spotlight of foreign media reports? Li Keqiang’s Government Work Report sets the expected economic growth target for this year at GDP growth of about 5.5 percent, which is higher than the general public forecast of around 5-5.5 percent. This target marks the first time in ten years that the government has aimed for growth higher than the rate of the fourth quarter of the previous year, which was 4 percent in Q4 2021. In a piece analyzing the situation, the Wall Street Journal reported that the risks and challenges faced by China’s development this year have increased significantly. A GDP growth target of around 5.5 percent is aiming for medium-to-high-speed growth and is mainly considering the needs for stabilizing employment, protecting people’s livelihoods, and preventing risks. This target is linked to the average economic growth rate of the past two years and the requirements of the 14th Five-Year Plan, which reflects the proactiveness of the Chinese government in responding to new challenges.

- Government work priorities:

- The Government Work Report pointed out that deepening reform and opening up to promote innovation remains the policy direction in 2022. China should unswervingly deepen reforms, expand its high-level opening up to the outside world, promote the steady development of foreign trade and foreign investment, and stimulate market vitality as well as the driving domestic forces of development.

- Foreign investment: Actively utilize foreign capital and implement fair treatment for foreign-funded enterprises. Expand the scope of encouraged foreign investments and support foreign investments in mid-to-high-end manufacturing, R&D, modern services, and other fields.

- Continue to improve the ecological environment: Promote green and low carbon development, as well as carbon neutralization, in an orderly manner.

- Effectively protect and improve people’s livelihoods: Improve the capacities of medical and health services. Strengthen social security and services. The per capita financial subsidy standards for residents’ medical insurance and basic public health services will be increased by 30 yuan and 5 yuan respectively. Improve the supporting measures for the three-child policy and develop elderly care and childcare services.

Highlights and expectations of the “Two Sessions” in 2022 through big data

According to data from ThePaper.cn, a week before the opening of the “Two Sessions”, the search popularity of the “Two Sessions” increased by 97 percent. Among these searches, top topics included social security, rural revitalization, education, ecological environmental protection, digital economy, technological innovation, and attention to public health. The “three-child policy” package is the hottest social security topic, followed by medical insurance and pension services. Among the hot ecological civilization topics, the public has been most concerned about the impact of the “dual-carbon goals“.

Expectations and impacts of the “Two Sessions”

We believe that the “Two Sessions” has released a clear signal of “steady growth”. In the near future, a series of measures to stabilize the economy in terms of the demand to supply ratio, investment and consumption, “new infrastructure”, foreign trade, the industrial economy, the service industry, and people’s livelihoods, environmental protection, etc. The accelerated implementation of measures in these fields will give a boost to economic growth.

In the future, we believe that the following areas are worth anticipating:

- Steady growth has become the main direction of economic work in 2022. How can China’s macro policies be implemented to meet challenges, stabilize the macroeconomic market, and keep economic growth within a reasonable range? How do government departments work together to implement policies?

- How will China continue to advance in important fields such as technological innovation, manufacturing, ecological and environmental protection, new infrastructure, and digitalization?

- How will China promote the security of people’s livelihoods, such as education, medical care, pensions, social security, and fertility?

Getting the strongest insights and takeaways from the “Two Sessions”

Tasks formulated in the “Two Sessions” can create major new opportunities and change the course of markets, however, it can be complex to parse through the vast swathes of new legislation and understand the impact on a given sector.

The Sandpiper Public Affairs Team has significant experience in “Two Sessions” policy tracking and analysis. The team has executed in-depth policy research in many fields covering national policies such as recent efforts to expand domestic demand, as well as industrial policies pertaining to advanced biomedical manufacturing and new energy technologies.

Sandpiper can be your resource for tracking the trends, events, and outcomes of the “Two Sessions”, providing in-depth insights, analysis, and customized intelligence tailored to your business sector and company.

You may also like: