Sandpiper Launches Voice Your Vision Pro-Bono Programme to Support Non-Governmental and Not-for-Profit Organisations in Asia Pacific

Smoking and Health Across Asia Pacific

Understanding Our Energy System and the Decarbonisation Journey Ahead

April 2023

By Sandpiper’s Energy and Environment practice team. Our team of experts advise companies on anchoring ESG at the heart of their organisations, help them communicate their sustainability story, and demonstrate the value they bring in the markets where they operate.

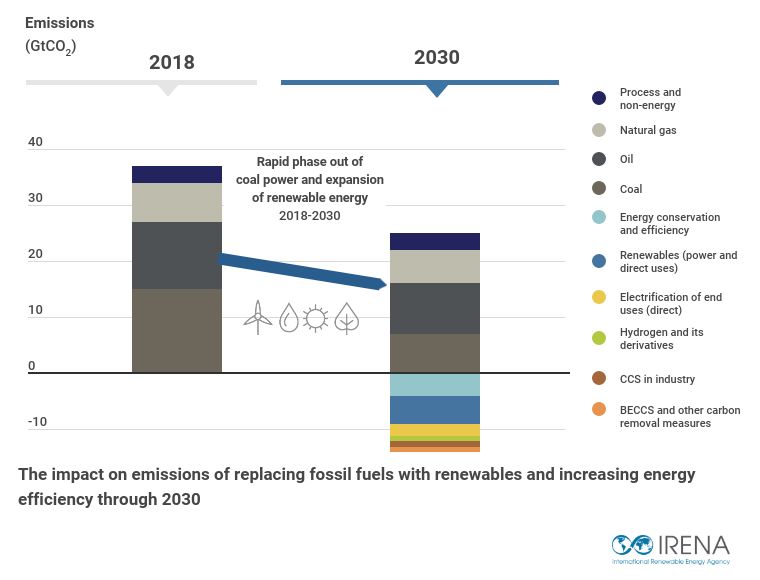

To invest in a net zero future we need to better understand our energy system and infrastructure and invest in energy options that add less or zero carbon dioxide (Co2) emissions into the atmosphere. In our present energy system, most energy comes from combusting fossil fuels. The amount of carbon dioxide produced per unit of energy generated is known as the carbon intensity. The highest carbon intensity fuel is coal, followed by oil, and lastly natural gas. Energy underpins our lives and our livelihoods. The energy sector is therefore one of the most important industries to better understand and engage with to facilitate a transition to a sustainable economy – so what is happening in this space?

The energy transition is gathering pace, with implications across industries, finance, and government, as the world shifts to a lower carbon future. However, much more investment in new energy sources is needed to meet future energy demand expansion, avoid exacerbating the current energy crisis and decarbonising our world.

Global investment in the low-carbon energy transition totalled $1.1 trillion in 2022 – a new record and a huge acceleration from the year before – as the energy crisis and policy action drove faster deployment of clean energy technologies, data from BloombergNEF (BNEF) shows. In another first, investment in low-carbon technologies appeared to hit parity with capital deployed in support of fossil fuel supply, noted BNEF.

Renewable energy sources are rapidly rising but still supply under 10% of global energy. Yearly spending on them is estimated at barely a quarter the $5 trillion required to displace hydrocarbons, according to the International Renewable Energy Agency (IRENA).

Energy security – the uninterrupted availability of energy sources at an affordable price – remains a real concern across the globe. Scaling up and investing in new low-carbon energies and decarbonising traditional energies is urgently needed.

The world needs to slash greenhouse gas emissions and address climate change. Crucially, the energy business has an outsized role to play and some of the key activities happening in the industry are:

Renewable Energy: The shift towards renewable energy sources, such as solar, wind, storage, biofuels, geothermal, and hydropower, is a major focus in the energy sector. Companies are investing in renewable energy infrastructure, developing renewable energy projects, and setting targets for increasing renewable energy generation.

Carbon Capture and Storage (CCS): CCS is a way of cutting carbon emissions, which could be crucial to helping tackle global warming. It is a three-step process, involving: capturing the carbon dioxide produced by power generation, hydrocarbon production, or industrial activity, such as steel or cement making; transporting it; and then storing it deep underground. Moreover, CCS could help decarbonise traditional oil and gas production. Natural gas has been touted as a cleaner fossil fuel than coal and “coal-to-gas switching” as a “bridge” to help countries transition to more clean-energy. In 2022, more than 140 new CCS projects were announced, reported the IEA. Planned global carbon dioxide storage capacity jumped by 80% and planned capture capacity by 30%. This is great news, however the project pipeline still falls considerably short of what the IEA and the Intergovernmental Panel on Climate Change (IPCC) suggest is needed by 2030.

Nuclear Energy: Nuclear, a cleaner alternative to fossil fuels, is increasingly being more widely recognised in decarbonisation goals. Nuclear energy provides pollution-free power with no greenhouse gas emissions. Many nuclear energy supporters argue that nuclear power is responsible for the fastest decarbonisation effort in history, with big nuclear players like France, Saudi Arabia, Canada, and South Korea being among the countries that posted rapid declines in carbon intensity and experienced a clean energy transition by building nuclear reactors. However, there is the risk of nuclear radiation release due toan accident, whilenuclear waste from the reactor needs to be carefully disposed. Advances in technology and design may be able to solve some of these challenges.

Energy Efficiency and Carbon Intensity: Companies are implementing energy efficiency measures, such as upgrading equipment, optimizing operations, and reducing energy waste. This not only reduces greenhouse gas emissions but also helps to reduce costs and improve profitability. Carbon intensity measures are also being used to show progress on the changing mix of energy products with carbon intensity metrics and targets being used to track progress.

Carbon Pricing: Carbon pricing is becoming increasingly important in the energy sector. Governments are implementing carbon pricing policies, such as carbon taxes or cap-and-trade systems, to incentivize companies to reduce greenhouse gas emissions. This is driving companies to reduce emissions and invest in low-carbon technologies.

Responsible Resource Management: Companies in the energy sector are increasingly focused on responsible resource management, including water conservation, land management, and biodiversity. This is driven by the need to minimize the impact of their operations on the environment and communities.

Stakeholder Engagement: Stakeholder engagement is becoming increasingly important in the energy sector. Companies are engaging with a range of stakeholders, including communities, investors, and NGOs, to understand their concerns and priorities and to build trust and credibility.

Ultimately, the energy sector is undergoing a major transformation towards a more sustainable future. Key trends in the sector include the shift towards renewable energy, decarbonisation technologies, such as CCS, carbon pricing, energy efficiency, responsible resource management, and stakeholder engagement. Understanding these major transformations and financing new innovations is key to protecting our future.

This is the first article as part of a short series over the coming weeks that will shed more light on the complexities of the energy sector and the key opportunities from our Energy, Environment and ESG Team.