Keeping Up With Competitors In A Changing Digital Landscape

Improving Business Growth Through B2B Social Media Content Strategy

How ESG Communications Can Make Or Break A Brand

By Kim Spear, Sandpiper Director, Hong Kong. Kim has nearly 20 years of experience in strategic communications with expertise in CEO communications, M&A, corporate restructuring, change management, thought leadership, reputation management and stakeholder engagement.

ESG Communications – More than a Trend

ESG has become a serious business since the pandemic. With 90% of central banks recognising climate change as a financial risk and a society that has been fundamentally altered in immeasurable ways. Last month’s United Nations report gave a damning confirmation when it released a “code red” warning to humanity – with its Intergovernmental Panel on Climate Change (IPCC) saying “Climate change is widespread, rapid and intensifying, and some trends are now irreversible, at least during the present time frame.”

As communications professionals advising clients across Asia and APAC, we have seen a surge in demand from clients wanting advice on how to engage on the topic of ESG.

Interestingly however, the understanding of what ESG is and what it should look like, varies greatly between almost every company and industry sector we work with. While many are comfortable to follow the lead of their head office for all ESG matters, locally based firms struggle to understand where to begin and what to implement or how to integrate environmental, social and governance strategies into their business and culture.

The danger of ESG and CSR thinking

The most common issue we see comes from looking at ESG through the lens of the company’s Corporate Socially Responsible (CSR) activities. While communications loves a good CSR programme, CSR only fits into a subsection of the ESG acronym.

There really is no one size fits all approach. Considerable flexibility remains in between local regulations and industry recommendations that leaves clients in the cold as to what ESG strategies they should adopt. From our viewpoint, much more work needs to be done to help businesses understand their green and sustainable position. As advisors in this area, industry bodies also need to adopt a coordinated approach to explain what can be done and easily adopted to enable those beginning their ESG journey in the best way possible.

For those firms with the financial means and with access to experts and professional ESG guidance, ESG strategies are much further established. The best ESG strategy, like any good business strategy, comes from those who are building measurable ESG programmes and embedding them into the company’s DNA. The best ESG strategies originate from those who see this as emanating from the inside out and from the top down. In this way, there are countless opportunities to engage employees, management, boards and external stakeholders to ensure ESG is core to the business and allows everyone to get behind it. This helps to reduce reputational risks when it is done right.

What is clear through the new lens of the pandemic-impacted world, is that it is no longer good enough to be measured against CSR activation programmes like cleaning plastic up from the beach. While it is absolutely a noble and good thing for any corporation and its employees to undertake, it is often not measurable on its own and would likely be categorised as a great CSR but not ESG activity.

ESG strategies need to run through the veins of the company culture and align more broadly with industry and regulatory requirements so that it can measurably achieve sustainable and environmental goals linking to carbon reductions and emissions.

Cutting through ESG noise – who to align to?

For companies in the financial sector, there is an entire toolbox of acronyms from A to Z that relates to green and sustainable alignment. In the highly regulated insurance and asset management or investments sectors, firms often align with one or a number of principles and guidelines like the GRI, SASB, SBTI, TNFD and many more, but it’s about more than alignment or signing up to an organisation to agree with its approach. Being a signatory requires a company to continually demonstrate progress towards the objectives or principles it agrees to and report that progress back each year. This is often done in the format of a sustainability report.

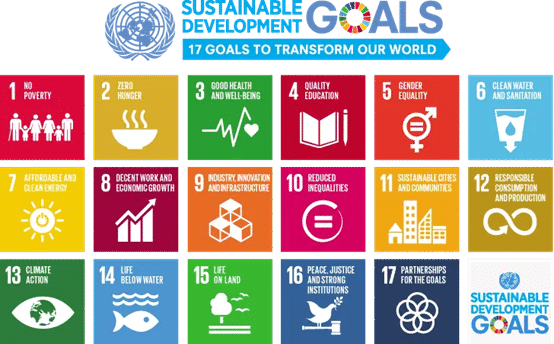

A common option for companies committing to their ESG journey is aligning to the United Nations Sustainable Development Goals (SDGs). While not many companies can adopt all of the principles, a selection of the most relevant options can support the right ESG strategy. As stated by the United Nations, the SDGs are a collection of 17 interlinked global goals designed to be a blueprint to achieve a better and more sustainable future for all.

Principles for Responsible Investment (PRI)

Many of our clients in the financial services sector align with PRI. This is a United Nations-supported network of investors working together to implement the six aspirational investment principles:

- Principle 1: We will incorporate ESG issues into investment analysis and decision-making processes.

- Principle 2: We will be active owners and incorporate ESG issues into our ownership policies and practices.

- Principle 3: We will seek appropriate disclosure on ESG issues by the entities in which we invest.

- Principle 4: We will promote acceptance and implementation of the Principles within the investment industry.

- Principle 5: We will work together to enhance our effectiveness in implementing the Principles.

- Principle 6: We will each report on our activities and progress towards implementing the Principles.

Greenwashing and reputational damage

Greenwashing and being labelled a greenwasher sends fear into the corporate world, but it is on the rise. Companies being accused of not being fully carbon neutral despite their claims has impacted companies like Volkswagen and Nestle. Others have been accused of overstating their green investment activities, resulting in share prices tumbling like it did for DWS. Deal makers also need to rethink how they manage their reputation like Australian fossil-gas giant Santos had to after being attacked by activists and facing court action for not doing enough to reduce emissions before its acquisition of Oil Search when the accuracy of its net-zero pledges were called into question.

Staying ahead of the curve on ESG means asking the tough questions. But with board level commitment, great professional advice and a good integration strategy, ESG success will benefit us all.

You may also like