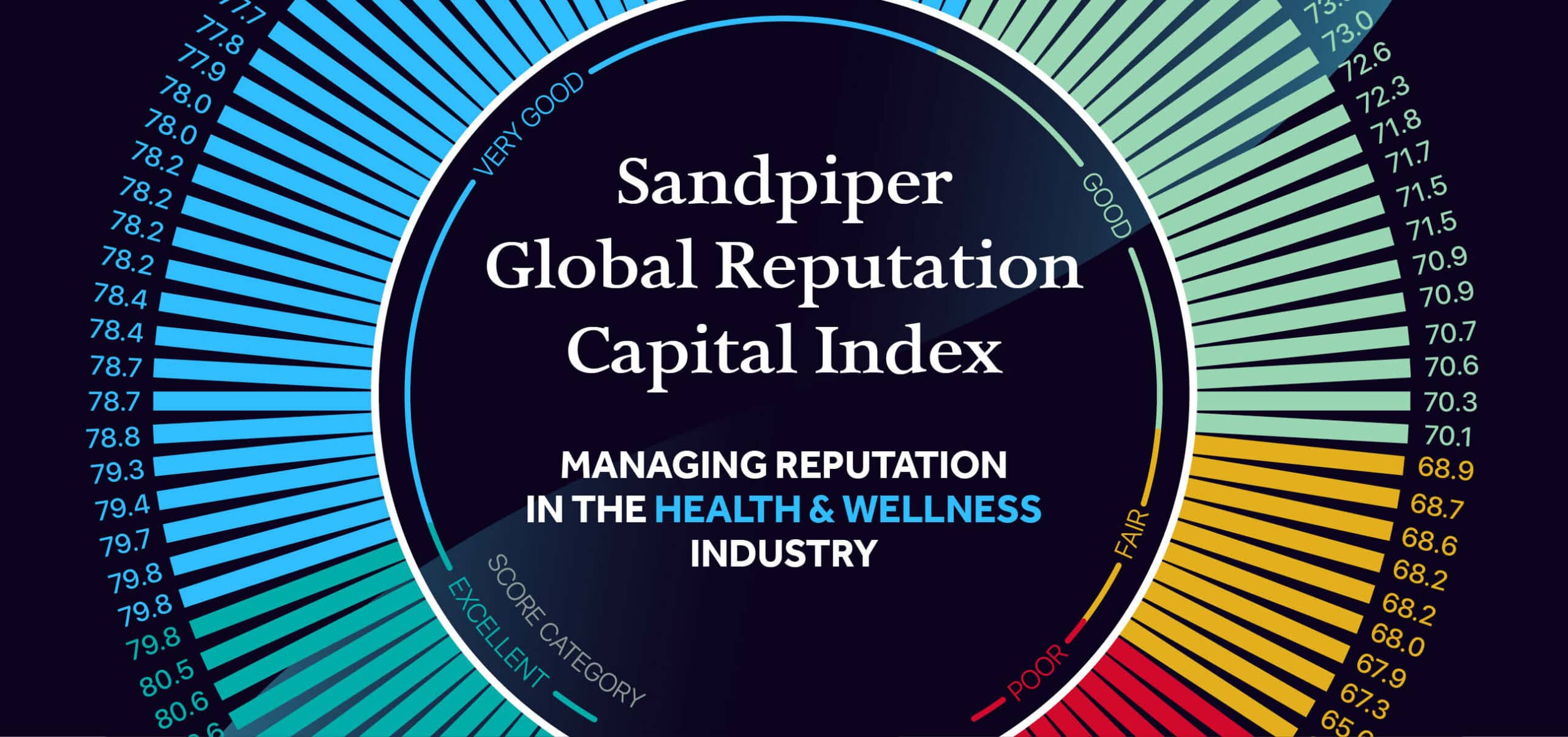

Launching Sandpiper Global Reputation Capital Index: Managing Reputation in the Health & Welness Sector Report

Risk and Reputation in the Private Credit Market

‘Two Sessions’ 2025: China Charts a Course Through Uncertain Times

February 2025

This article is part of Sandpiper’s Public Affairs Tracker content series. Our Public Affairs team provides in-depth monitoring and analysis on emerging political and macroeconomic issues, helping companies formulate appropriate strategies for challenging business environments. Click here to explore other recently published articles.

The world’s eyes will be on Beijing again over the coming week, as China’s political leadership gathers for the third session of the 14th National People’s Congress (NPC) on Wednesday 5 March, following the annual national meeting of the Chinese People’s Political Consultative Conference (CPPCC) the day before.

This year may prove to be an inflection point for China’s macroeconomic strategy, as domestic challenges risk being exacerbated by an increasingly uncompromising external environment. Like many other countries, China is having to contend with the effects that a US protectionist turn could have on global trade. China has already been quick in reacting to the new landscape, with a raft of export controls and retaliatory tariffs of its own – and the ‘Two Sessions’ will likely provide the outlines of a more concerted and sustained Chinese response.

Many questions remain on the domestic front as well, and investors and business leaders alike will be looking to the ‘Two Sessions’ for answers. The last twelve months have left ambiguous messages about economic priorities. Last summer’s Third Plenum hammered home the centrality of innovation and technological development, while making scarce mention of consumer spending and demand. In contrast, the all-important Central Economic Work Conference (CEWC) in December explicitly raised consumer spending to the top of the agenda. The sequence of stimulus measures begun last September may also herald bigger things to come, as 2024 ended with promises of a more proactive fiscal stance and looser monetary policy in the new year.

Most of China’s top-level meetings take place behind closed doors, and decisions are only revealed in the broadest of brush strokes – until the ‘Two Sessions’ meeting. When the ‘Government Work Report’ is unveiled, the blanks are finally filled with more specific policy indicators. Our specialist Public Affairs team will be here to guide you through it all.

Here are some themes we’ll be watching closely:

- GDP growth, budget and deficit targets for the coming year will be revealed, reflecting the leadership’s priorities and expectations for the economy

- Progress toward existing development targets and elaboration of long-term priorities, in preparation for the 15th Five-Year Plan (2026-2030)

- Greater clarification on balancing economic growth with national security

- More specific policy details on addressing China’s top strategic economic priorities for 2025, as identified at the CEWC – namely, stimulating domestic demand and consumer spending, promoting ‘high-quality productive forces’, and tackling deep-seated inefficiencies through structural reform

- Details and a timeline for further monetary and fiscal stimulus measures

- Assessment of external environment and projections for foreign policy in the face of growing trade frictions and technological competition with both the US and EU

For all international businesses that operate in China, we recommend a robust plan to understand the ‘Two Sessions.’ The developments, outcomes and implications of the most important week in China’s political calendar require knowledge of the broader context of announcements. We recommend that international businesses start planning now to have appropriate guidance on how the ‘Two Sessions’ will impact their organisations in both the short and long term.

- Understand the context: The ‘Two Sessions’ are built on previous years’ announcements. Understanding the development of policy over time is essential to interpreting the impacts of potential changes in advance of the meetings.

- Keep up to date with announcements: In a fast-changing geopolitical environment, real-time updates can help organisations adapt as news from the sessions becomes public, giving organisations the added element of time to shift their strategies.

- Set a plan based on key developments: After the ’Two Sessions’, organisations will need to amend their strategies and update approaches. Converting intelligence from the sessions into actionable plans is key.

Finally, it’s also important to educate the broader organisation: While not everyone in an organisation is responsible for China-related decisions, knowledge of how policy changes here can affect the business is key. Educating stakeholders is an important part of ensuring strategies are effective.

To discuss your interests and needs and to sign up for any of these services and your customised “Two Sessions” analysis, please contact Chinapolicy@sandpipercomms.com.